We are LIMES international

We advise individuals and companies that operate across borders.

Globalisation offers unprecedented opportunities to talented, ambitious people and organisations with international ambitions. However, in addition to challenges and opportunities, it also gives rise to complex laws and regulations, so specialist integrated support in the area of tax law and other legal matters is essential.

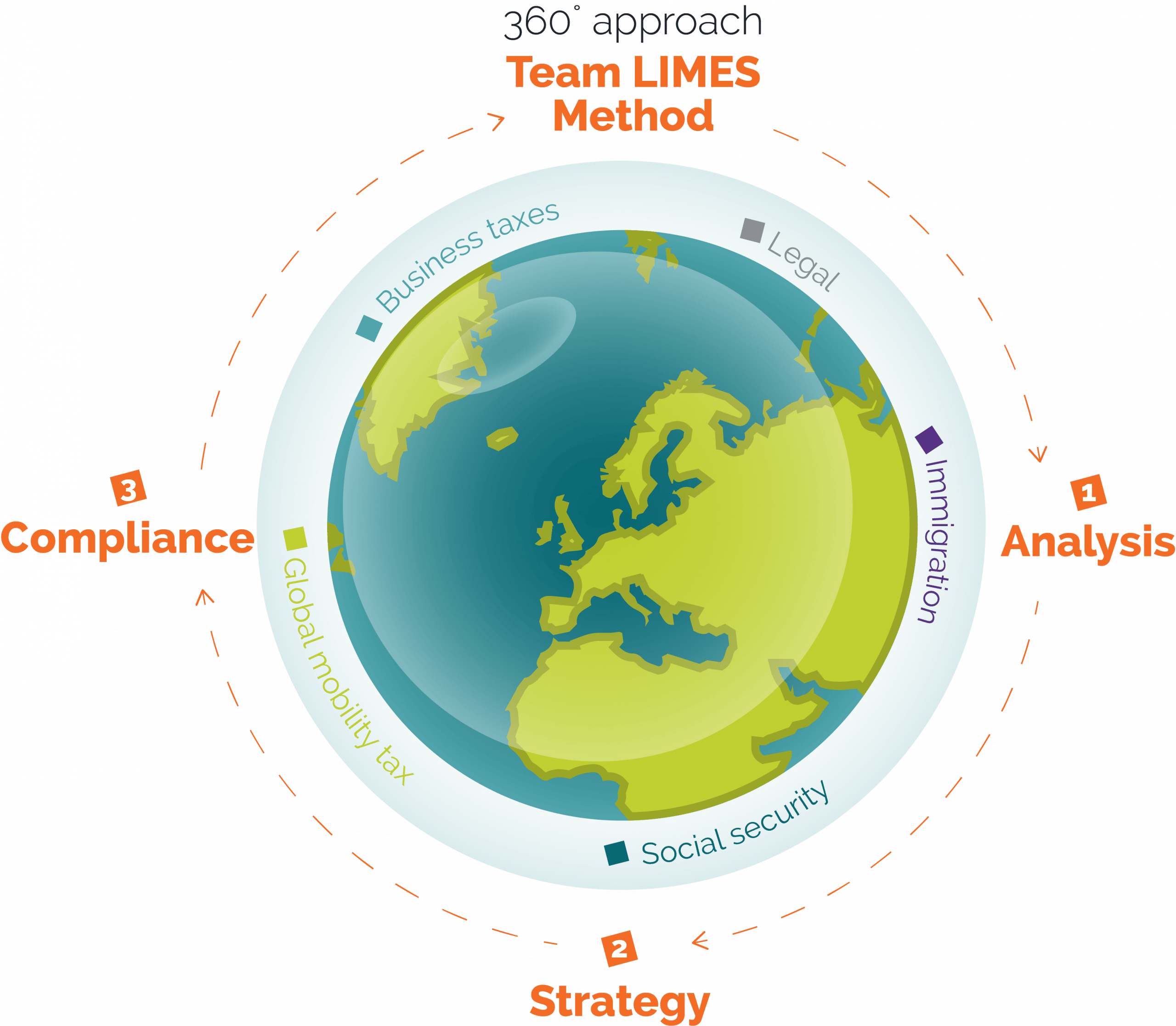

We work according to the Team LIMES Method. We form teams for our clients in the areas of business taxes, global mobility tax, legal, social security and immigration. Our three-step approach of analysis, strategy and compliance creates a range of insights and perspectives so that we can ultimately offer the best integrated solutions and guidance. But it also ensures we are compliant, risks are mitigated and we can make the most of any advantages. That is what sets us apart and makes clients choose us.

LIMES international. Realising cross-border ambitions.

“Sending employees abroad is complicated. This requires expertise and focus. As a specialist we help clients with safety and security, LIMES international is the specialist with focus on tax and legislation. This is where our paths cross and where we complement each other when it comes to international work. LIMES is a great and pleasant partner to work with, also when it comes to LIMES academy.”

“We have been using LIMES international for tax advise and tax submissions for our expatriates to great satisfaction – the combination of a strong personal touch, proactivity and a high level of competence brings a unique value proposition to the table – on top the LIMES people are friendly and easy to deal with.”

“In the collaboration with LIMES I appreciate the professionalism, the short lines and the personal contact. That professionalism certainly also finds its place in LIMES academy and in the regional as well as national visibility in terms of changes in legislation and regulations.”

“For me, LIMES means professional, well-thought-out answers to simple questions and specific hands in the elaboration of these thoughtful answers without unnecessary work. With LIMES it is right!”

Newsflash

Latest news about 30% ruling

Yesterday, the Dutch Tax Authorities have taken the position that access is granted to [...]

30% portal is live!

After a long wait, it is finally here: Our 30% portal is live! This [...]

Social security international teleworkers

On 5 June 2023, we informed you about the EU Framework agreement under which, [...]